|

|||

|

|

|

||

|---|---|---|

|

||

|

||

|

||

|

||

|

||

|

||

|

|

|

|

Understanding the 30 Year Mortgage Rates Chart and Its ImplicationsIntroduction to Mortgage RatesThe 30 year mortgage rates chart is a vital tool for anyone looking to understand the long-term trends and fluctuations in mortgage interest rates. This chart can help potential homeowners make informed decisions when considering a mortgage. Historical Trends in Mortgage RatesDecade-by-Decade AnalysisMortgage rates have seen significant changes over the past few decades. In the 1980s, rates were notably high, often reaching double digits. In contrast, the 2000s and 2010s saw much lower rates, often below 5%.

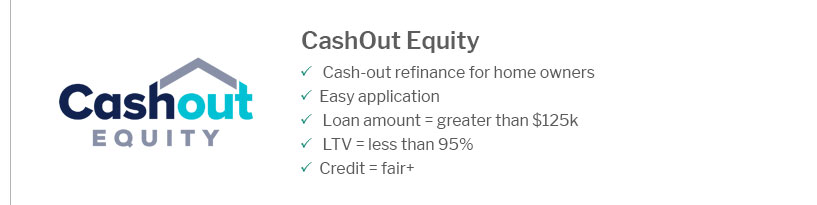

These trends are crucial for understanding the current market. Factors Influencing Mortgage RatesEconomic IndicatorsVarious economic factors influence mortgage rates, including inflation, unemployment rates, and the Federal Reserve's monetary policy. These elements can cause rates to rise or fall, impacting affordability. Global EventsGlobal events, such as financial crises or geopolitical tensions, can also affect mortgage rates. Understanding these factors can aid in predicting future rate changes. Practical Applications of the 30 Year Mortgage Rates ChartUtilizing the chart can help potential homeowners or investors decide the best time to lock in rates. Additionally, exploring best refinance options for mortgage can optimize long-term financial planning. Comparing Fixed vs. Variable RatesFixed-rate mortgages offer stability, with the same interest rate throughout the loan term. On the other hand, variable-rate mortgages can fluctuate with market conditions, sometimes offering lower initial rates.

FAQ Section

https://www.cnbc.com/quotes/US30YFRM

30-Year Fixed Mortgage Rate MND.News US30YFRM:Exchange - Open6.80 - Day High6.80 - Day Low6.80 - Prev Close6.80. https://fred.stlouisfed.org/graph/?graph_id=281291

Graph and download economic data for 30-Year Fixed Rate Mortgage Average in the United States from 1953-04-01 to 2025-03-25 about 30-year, fixed, mortgage, ... https://www.fedprimerate.com/mortgage_rates.htm

Mortgage Rates History. - Mortgage Rates: Recent / Median / Cumulative Average / Mode / Chart - 30 Year Fixed-Rate Mortgage All-Time High | 30 Year ...

|

|---|